SABAI SABAI FX

Dow Theory Trend Visualizer

Develop Multi-timeframe analysis skills

with the most fundamental market behavior theory

Many of beginner traders and developing traders struggle

because they do not have eyes to analyze the market with multi-timeframes.Elevate your trading skills mastering MTF analysis and

break the ceiling of break-even traders.

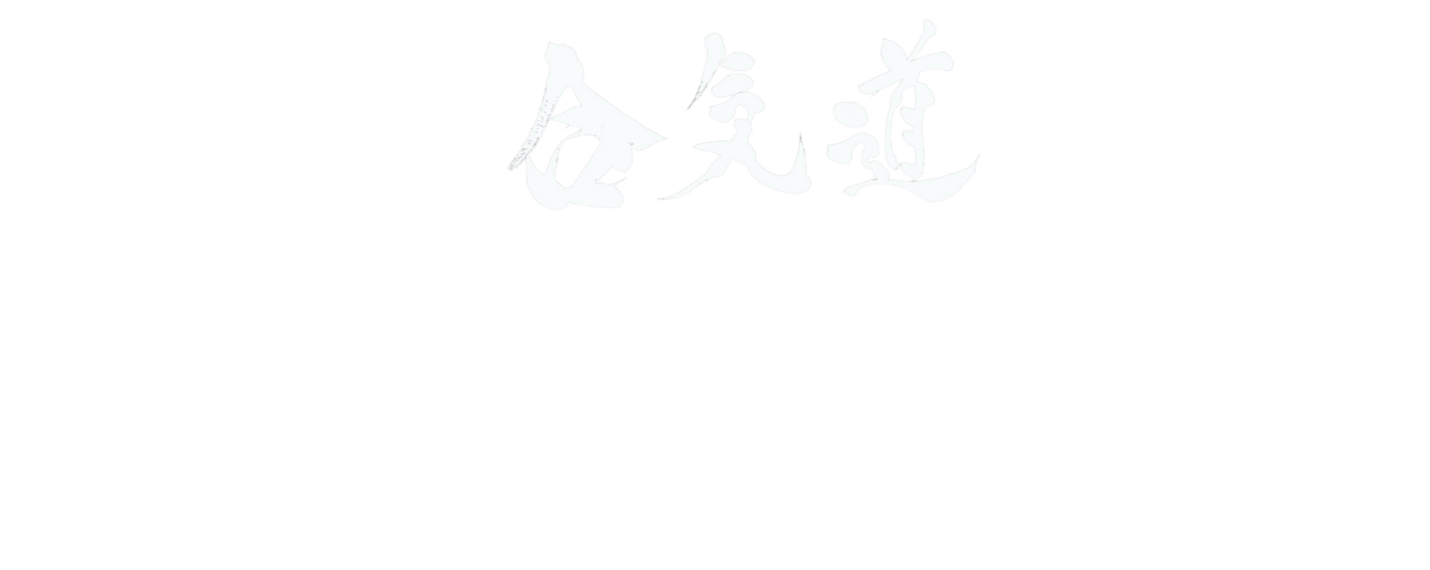

The video above shows some of the features only.

What is dow theory?

The classic

Dow Theory is market behavior analysis method developed by Charles Dow; a founder of The Wall Street Journal and Dow Jones & Company, Inc. and organized and represented by William Peter Hamilton.Dow Theory consists of six principles clarifying the definition of trends, three key movements of the market and three phases in major market trends and other elements related to trend definition.Dow discovered these principles, analyzing mainly stock market activities and it is still widely used in various asset markets as technical analysis methodology.

next-gen visualization of

MTF Trend Directions

This indicator displays trend directions in multi-timeframes based on Dow Theory utilizing the latest visualization technologies.It is designed to help traders/investors develop multi-timeframe analysis skills and their own perspective on the market.

What is AIKIDO?

Aikido [aikiꜜdoː] is a modern Japanese martial art and self-defense system that redirects the opponent's attack strength and momentum. By using attackers' force against themselves and involving off-balance, opponents fall or are thrown by their own power.

Utilizing Upper timeframe Momentum

AIKIDO Trading is the trading concept invented by SABAI SABAI FX while teaching chart reading skills to its students.

It is characterized by the fact that lower timeframe is always influenced by upper timeframe, therefore taking a position which aligns with upper timeframe's trend direction enables traders to obtain help from the market just like AIKIDO.But how does this indicator enable that?

master trend following

and

reversal trading

The indicator displays signals when trends change so that you catch opportunities for trend trading and reversal trading with alert setting options.The left chart illustrates an example of signals where a trend reversal in the chart timeframe and trend continuation in the upper timeframe happen.This is exactly when traders can take a position aligning with an upper timeframe ; AIKIDO

Signals available:1. Bull(+)/Bear(+) :

When the chart timeframe's trend and the upper timeframe's trend has got the same direction

2. Bull/Bear:

When the chart timeframe's trend changes

MTF HH/LH/HL/LL

Higher timeframe is always a key to develop your trading scenario where the market is likely to head.The indicator displays Higher High/Lower High/Higher Low/Lower Low of an upper timeframe so that traders will not miss upper timeframes' support and resistance, which can be considered liquidity to be taken/targeted.

(Support, resistance, liquidity...

It's all about how you view the market. )

classic is forever

basics are the foundation of your skills

Why Choose US

Pricing

39 USD

110 USD

(SAVE 5%)

350 USD

(SAVE25%)

30 Day Money Back Guarantee(only for monthly plan)

Copyright©︎SABAI SABAI FX All Rights Reserved

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.